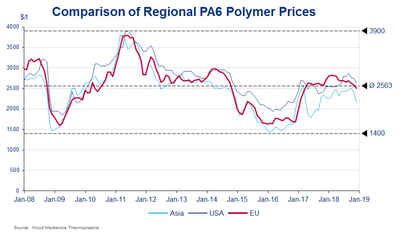

The drivers of this situation were many and varied. First, there was the severe global economic crisis of 2007-2009, which caused demand for all goods, PA6 included, to disappear virtually overnight. Prices collapsed, PA6 lost half of its value, and margins disappeared. The whole market was taken by surprise, due in part to a certain carelessness that had reigned in the market where every supplier had a decent share of the cake.

This first tremor was strong, with its effects lasting for about two years – but the recovery was possibly just as dramatic. There followed a period of euphoria on the demand side, resulting in commodity prices reaching levels never seen before. The peak was reached in the first half of 2011, when prices around the world almost touched $4000/tonne. It must be said, as frequently occurs in periods of euphoria, that there was a widespread feeling that the good times would go on forever. But as on all roller coasters, the change was brutal and quick. Within four months around the turn of 2011/12, PA6 prices tumbled to $2,500/tonne, which was below cost.

The past, future and present of the polyamide industry

How the Chinese over-supplied the market

This second tremor was partly caused by the demand bubble bursting, partly by the first massive wave of new Chinese capacity in PA6 that saw excessive amounts of material hitting historical European and American export markets in China itself and across Asia. Global prices were now being influenced by the Chinese spot market, where prices were no longer determined by “cost plus,” but by supply and demand. Over-supply was the result of Chinese newcomers thirsty for market share and with less focus than established players on short-term profitability. Exports from the West to China reduced significantly, as demand in the country, both for finished products and polymer, was increasingly catered for by local producers.

Following this second tremor, market and prices found a new level – lower but still manageable. Standard Chinese polymer, after early attempts, had difficulty penetrating Western markets, resulting in numerous efforts by Chinese producers to optimize their assets to improve their competitiveness. At the same time, decisions began to be taken by Chinese suppliers to exit certain market segments, given that neither short- nor long-term profitability could be assured there.

The second Chinese wave

But then in 2014, what many had feared actually came to pass: material from a second Chinese wave of new capacities hit the markets, pushing world prices for PA6 and its intermediates down again to levels close to cash cost. Everyone lost money – again, and for a long time, up until the end of 2016.

Some traditional players in Europe and the USA have gone through strategic rationalization programs to combat this situation and return to sustainable minimum profitability levels. Others have taken a more sanguine view, arguing that, despite clear overcapacity, Asian producers are unable to gain an important position for their products on Western markets.

Fortunately, the price of crude oil has remained low; and even now, after some increases, the trend appears for it to remain at around $60/bbl. for the foreseeable future. That is a good sign for the price of key nylon feedstock benzene, which has a strong correlation with oil.

In any case, there has been a moderation of the original strategy among Chinese suppliers to expand aggressively into global markets, increasingly aware of the importance of back-up services for customers behind the basic product (which in large part they did not have) – and the essentially local nature of nylon fiber markets, with suppliers willing and able to adapt their products for specific applications. ln the end, simply swamping markets with material helps nobody.

Why the industry demands PA66 replacement

The supply/demand balance has also been affected in recent months by a long series of declarations of Force Majeure among suppliers of PA66, and a severe shortage of adiponitrile (a strategic raw material for the polymer), which has pushed PA66 prices to historical highs and caused users to think very hard about whether it may be possible, at least in some applications, to switch to PA6. At the same time, it has also helped suppliers of PA6 to maintain a reasonable margin for their own product.

This argument is particularly pertinent in the tufted (broadloom) carpet market in Europe, where nylon yarns are still very much in use. The share of carpet tiles for offices is still growing, but historically the yarns they use have been PA66. Now though, more and more producers are working on developments using PA6 yarns, because of the ongoing price differential.

Carpets yarns: search for innovation in times of uncertainty

Moreover, the carpet sector would be helped by the creation of more new developments in yarns. Overall, players in the BCF carpet yarn market need to innovate more and add new or improved properties. The same goes for processing of carpet yarns into end applications. The market needs to invest in technologies allowing for more efficiency, higher spinning speed and greater product diversity.

In addition, certainly in Europe, there are the issues, not only of competition from Asia, but also the uncertainty about Brexit. In fact, Brexit may have a huge influence on European sales of carpet: until now, some large broadloom carpet producers in Belgium and the Netherlands have depended on the UK for as much as 60% of their sales.

Looking ahead

As an overall conclusion, we can see is clear that, after so many recent adventures, the position of PA6 is increasingly being confirmed as a material of choice for many key industries, in a demanding environment where reliability, profitability and sustainability remain the main challenges ahead. But we could all do with an end to the roller coaster price ride, and a future that is just a little bit more stable and predictable.

DOMO Chemicals would like to thank Wood Mackenzie Thermoplastics for supporting the article. A short version of the text was published in the magazine Chemical Fibers International 1/2019.